Donaldson Impact Investments is committed to acquiring existing multifamily properties and transforming them into environmentally efficient and affordable housing solutions. Guided by a thoughtfully designed Impact Investment Strategy (IIS), we implement proven programs in decarbonization, energy efficiency, and water management to reduce environmental impact.

Our mission strives to enrich communities through responsible and meaningful initiatives, enhance operations with targeted capital investments, improved security, and stronger resident relations, and optimize efficiency. By delivering measurable financial, environmental, and social returns, Donaldson Impact Investments creates value for both our investor partners and the communities we serve.

Donaldson Impact Investments was founded by two senior executives from Donaldson, a renowned property management and real estate investment firm, to address the critical need for affordable housing in the Washington, D.C., area. The company focuses on acquiring older multifamily properties and implementing innovative strategies to deliver positive financial, environmental, and social outcomes.

Contact Us

By leveraging their expertise in real estate investment and property management, Donaldson Impact Investments targets existing rental properties in the DMV region, identifying value-add opportunities that ensure long-term affordability. The strategy aims to secure affordability for 60% of units, making them accessible to residents earning 60% of the Area Median Income.

Building on a 20+ years of multifamily industry experience, Donaldson Impact Investments will lean on Donaldson’s expertise with complex projects such as central plant decommissioning and implementing energy and water-saving programs. In addition, the company will collaborate with nonprofits, advocacy groups, and local governments to provide impactful community programs, including financial literacy, social services, health education, and wellness initiatives.

Renowned for its ethical business practices, Donaldson is highly esteemed by clients and partners. Recognized as a Top 20 Values-Driven Employer in the Greater Washington, D.C. region and a sustaining member of the Multifamily Impact Council, the company exemplifies its unwavering commitment to responsible governance and meaningful community impact.

Contact Us

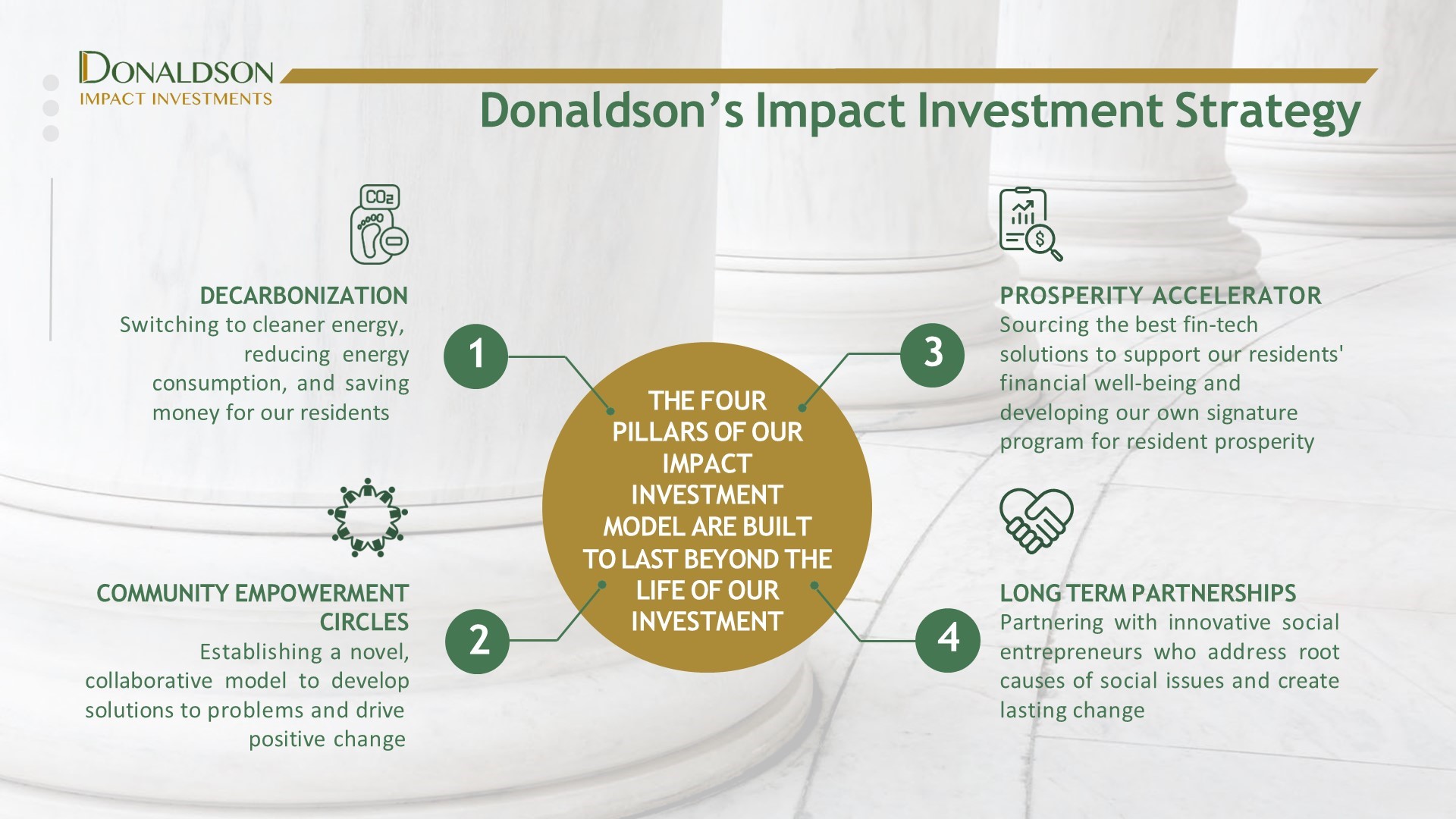

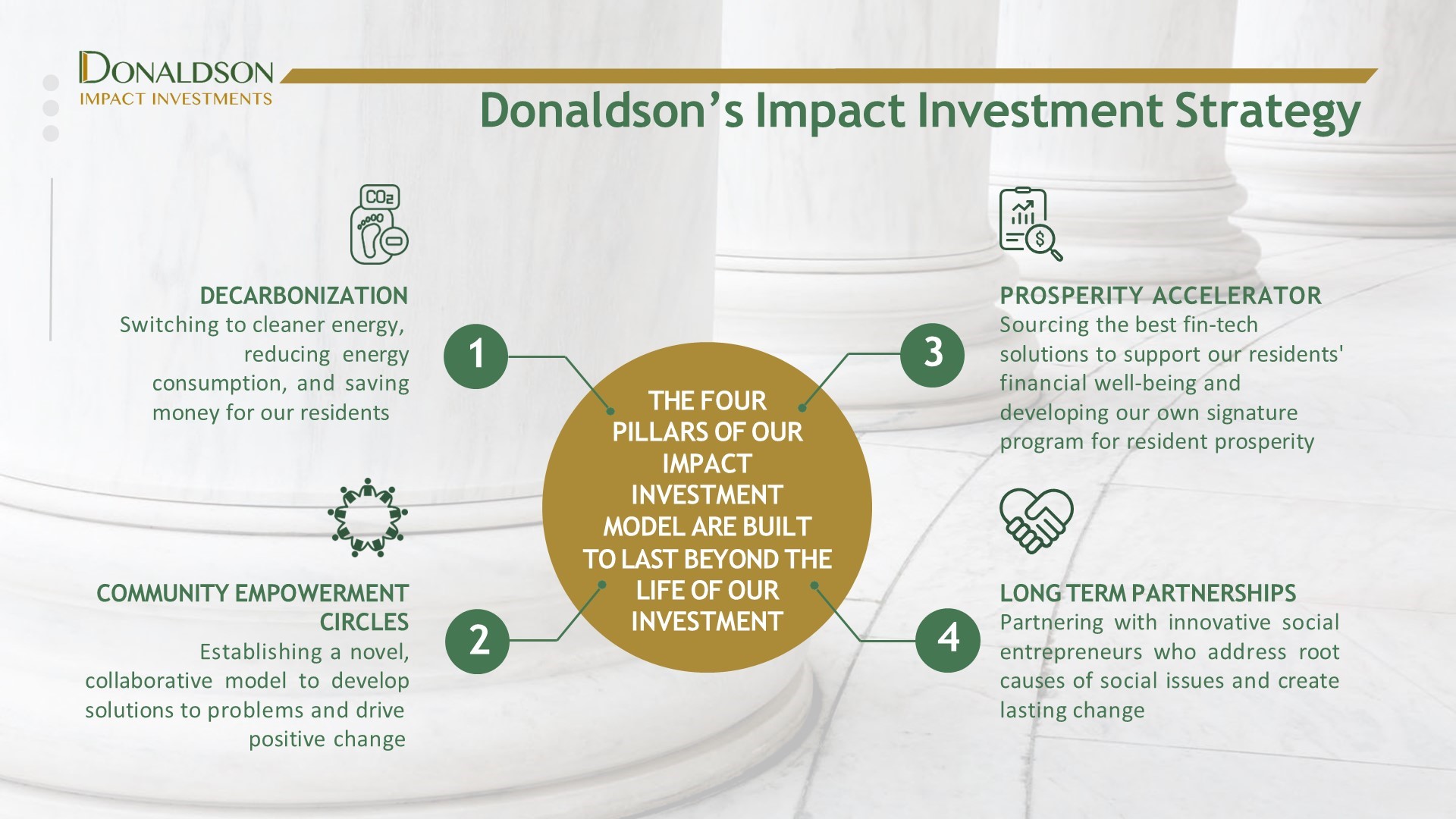

The Four Pillars of our Impact Investment include:

Pillar 1: Decarbonization

Our mission is to transform existing multifamily housing by advancing decarbonization efforts. This includes replacing outdated central utility plants with highly efficient, individually controlled electric mechanical systems in each apartment. These upgrades empower residents with year-round flexibility to manage heating and cooling while directly controlling their energy consumption, resulting in reduced utility costs and improved energy efficiency. This transition not only enhances sustainability but also lowers maintenance expenses, delivering a more personalized and environmentally conscious utility experience for residents.

Pillar 2: Community Empowerment Circles

Community Empowerment Circles (CECs) cultivate a shared sense of responsibility among residents, management staff, and stakeholders, empowering them to collaboratively address community challenges. This initiative fosters lower resident turnover, heightened pride and belonging, and stronger adherence to lease agreements, all while building a more connected and resilient community. The ripple effects include improved employee productivity, enhanced online reviews, increased safety, reduced vandalism, and strengthened affordability, creating a thriving environment for all.

Pillar 3: The Prosperity Accelerator

The Prosperity Accelerator is a comprehensive, step-by-step program designed to improve financial outcomes for lower-income residents. By promoting on-time rent payments, reducing delinquency rates, and increasing lease renewals, the program addresses the interconnected challenges residents face, paving the way for financial security, stability, and wealth accumulation. Residents benefit from increased savings, reduced financial stress, improved credit scores, and fewer evictions. Ultimately, the Prosperity Accelerator fosters a more financially resilient and empowered community.

Pillar 4: Long-term Partnerships for Sustainable Impact

Donaldson Impact Investments is deeply committed to partnering with social entrepreneurs, making these collaborations the cornerstone of its impact model. These innovators address the root causes of social challenges with creative, transformative solutions that drive lasting change. Their initiatives are introduced to Community Empowerment Circles (CECs) as potential long-term strategies, fostering enduring partnerships to implement meaningful solutions within local communities.

"Donaldson Impact Investments is bringing together the right tools with the depth of knowledge and experience to implement innovative solutions that prioritize affordability, equity and inclusion." Kevin Smith, Chief Investment Officer

"Donaldson Impact Investments is bringing together the right tools with the depth of knowledge and experience to implement innovative solutions that prioritize affordability, equity and inclusion." Kevin Smith, Chief Investment Officer

Through our proactive approach, we have successfully reduced water consumption by nearly 50% across nine properties within Donaldson’s management portfolio. By anticipating environmental regulations, lowering operational costs, and championing initiatives such as recycling, improving air quality, and creating green spaces, we are not only minimizing our environmental footprint but also actively contributing to environmental regeneration.

Here are specific case studies:

Brinkley Manor – Temple Hills (126 Units)

- The utility expense has decreased by 74%

- NOI has increased by $266k

- Added value has increased by 4.8 million*

Montgomery White Oak – Silver Spring (592 Units)

- The utility expense has decreased by 43%

- NOI has increased by $818k

- Added value has increased by 14.8 million*

*Based on a 5.5% cap.